EPFO has brought some major changes in the way it works and a new system called UAN (Unique Account Number) is in place now. This UAN is a way to simplifying the process of collecting and managing the provident fund money for employees.

Background – The pain of old EPF system

Before I start explaining, Let me go back a bit to help you understand a bit of background. Earlier when a person joined a new job for the first time, he got an EPF account opened by the employer where his provident fund money was deposited. For years, this money got accumulated in that EPF account.

Now when this person left his job and joined some other organization, the new employer again assigned him a new EPF account and started depositing his provident fund money in that account. This way, if a person changed his job 5 times, he had 5 different EPF account numbers and in case he wanted to withdraw his EPF money, he had to apply at 5 different employers or transfer then one by one to his latest EPF account and this called for a big headache

This way, if a person changed his job at 5 different places, he had 5 EPF accounts and now he had to either withdraw money from his EPF accounts one by one , or they have to transfer the old EPF money to new EPF account. But that was a big pain!.

Transferring your old EPF money to new EPF meant filling up the forms, then EPFO department sent to your old employer to get their signatures and if they denied or didn’t exist at all (if they closed down), then things would fall apart and now you were stuck with no information, no proper status and no idea what you need to do. Calling EPFO department or emailing them didn’t work most of the times, and a lot of people just let their old EPF account exist and didn’t do anything, because of sheer amount of uncertainty and ambiguity. This whole system was raw, old and not friendly for the employees at all.

Things have changed now quite a bit after UAN has been introduced and most of the pain points have been addressed. Let me now share some critical points about UAN or Universal Account Number as its called.

What is UAN?

In simple words, UAN is a 12 digit single account number which will be linked to your provided fund money. Now you don’t need to worry for different EPF accounts and then transfer them, when you join a new job. Now each employer will just give you a member id, and all those member id will be linked with the same UAN. Even the employee’s having EPF under private trusts will be assigned the UAN.

This is the new system and will be applicable now for your current and future employment. Any EPF account you had before this, sadly will not be handled in this system. You will have to manually deal with old EPF accounts, for anything new will now be under UAN. The image below clearly shows the situation now and then.

3 Steps of obtaining and activating your UAN ?

Below there are steps to be followed if you want to get your UAN and activate it.

Step 1 – Get the UAN from your Employer

The first step is to ask your employer for your UAN. EPFO department has already allotted most of the UAN (4.2 crores as the last count) and communicated it with employers. So most probably your employer must have shared your UAN number to you. If your employer has not yet shared it with you. You can still validate if your UAN has been issued or not. For that, you need to follow the steps below

- Go to http://uanmembers.epfoservices.in/check_uan_status.php

- Choose your State and Office jurisdiction for EPF

- Enter your Establishment Code and EPF account number

Then click on the “Check Status” button and it will show a message saying “UAN is activated” in case it’s already activated by EPFO department. Once you see that message, then check it with your employer. Below screenshot gives you an idea about how to do it.

So like this, you can first verify if your UAN is allocated or not against your EPF. Also note that UAN is to be allotted to only contributing members whose accounts are active. All the dormant/inactive account is going to get closed. So if you have 3 EPF account, out of which 2 are old and dormant, please check the status using your current EPF account number which is active.

2. Activate the UAN

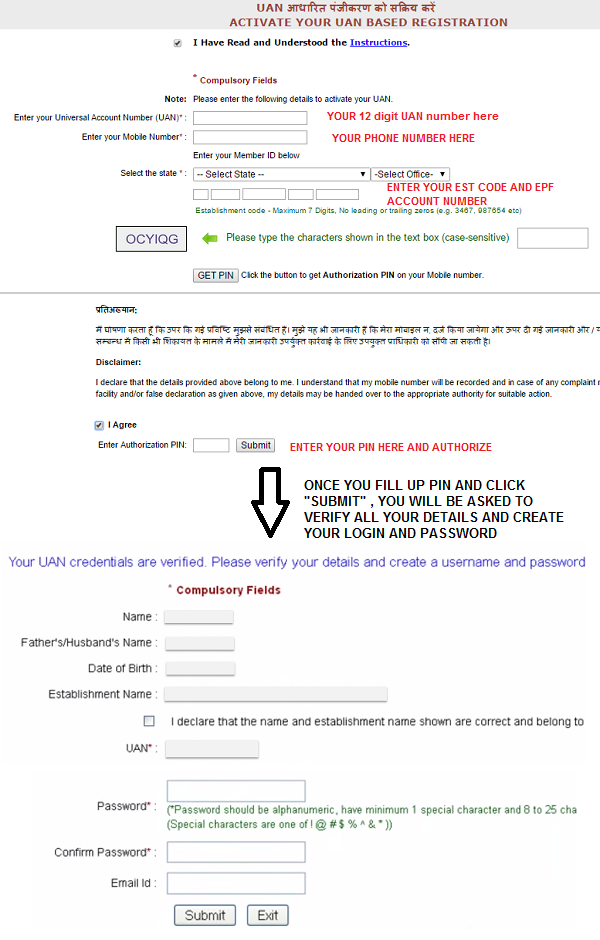

The next step is to activate your UAN. For that, you need to follow the steps below

- http://uanmembers.epfoservices.in/uan_reg_form.php

- Enter your UAN, mobile number and EPF account details

- Get authorization PIN on your mobile

- Submit PIN and activate your UAN

- Then generate your login/password and registration is complete.

3. Update your KYC details

After that, you should login to UAN portal with your username and password and once you enter the portal, you will see many options like for downloading passbook, downloading UAN card, and editing your details. Apart from that you will see an option to Edit your KYC Details.

Following are the documents which can be used for KYC. You need to upload a scanned copy of any one document

- National Population Register

- AADHAR Card

- Permanent Account Number

- Bank Account Number

- Passport

- Driving License

- Election Card

- Ration Card

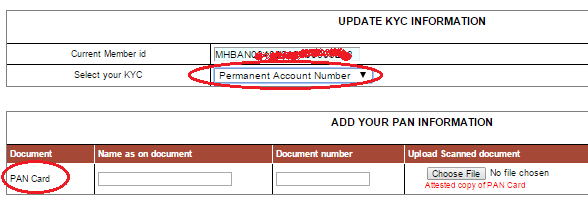

Below you can see an example of how it looks when you choose PAN as an option.

Special Benefits of UAN

Let us now see some of the benefits of UAN compared to the old EPF system. Some changes in UAN were really required from last many years (even decades). Let’s see them one by one.

1. Communication directly between employee and EPFO

The best thing about UAN is that, now the communication can happen directly with EPFO and Employee. Earlier employer was in between employee and EPFO for most of the things, especially for withdrawals and transfer of EPF. Your employer had to sign the documents from their side, now this will not happen. Employer will now act like a depositor in your account and nothing else.

2. UAN will remain same throughout the career

The best part is that Universal account number is going to be same throughout your whole career. Each time you change your job, all you need to do is provide your UAN to your new employer and he will tag the member id they create for you to that same UAN. Note that your overall career moves will be recorded at one place, because your UAN is nothing but a central database of all your employers and your past employment, but this will only be visible to employee and no one else.

3. Sms notifications when your provident Fund is deposited

Now each month, when your employer deposits your provident fund money, you will directly get a SMS notification informing you about it. This is really great – because now you know, if your employer is actually depositing the money with EPFO or not. This will be exactly like you get notifications from your bank when your account is credited with salary. This is especially nice, because in past there have been cases where employer didn’t deposit the EPF money for years and months and employee came to know about it much later and then they had to lose their hard earned money

4. Update your KYC at one place

Now you just have one single window where you can update your address, mobile, email and other KYC details incase they change in future. A lot of issues happened in earliar model where the same person had different address and contact details with different employers and that created issues while withdrawal and transfers.

5. Transfer of your Providend fund money automatically

Now transfer of EPF is very simple. When you join a new job, you just need to furnish your UAN number to your employer and automatically within 1-2 months, your providend fund money will be transferred. In a way it just has to get linked to your UAN

6. Extremely friendly process for EPF withdrawal or Applying for Loan

This is still in process, and can take up more than 6 months to an year, but once its complete, then the process for withdrawal and loan will be super fast and simple. You might not be aware that you can withdraw from your EPF for important events in life like marriage, buying a house, or medical emergency subject to some rules and restrictions.

Once UAN system is fully functional, you then just need to fill up a form and provide your fingerprint to a biometric reader and once things are matched, the amount will be transferred to your registered bank account within an hour. This used to take months and years earlier. I am not sure if in reality it would be as simple and fast, as they claim – but still things are bound to get simple and fast.

Conclusion

Make sure your UAN is activated and you have uploaded the KYC document. If you have any other queries regarding UAN, please share it with us and we will try to find out the answer.

The post UAN – All you wanted to know about the new EPF system appeared first on Jagoinvestor - Personal Finance Blog.